Expert or long-time professional traders usually rely heavily on their knowledge, experience, and analytical abilities to trade. However, most forex traders, whether novices or have experience trading in the past, find forex signals important insights for making informed trading decisions.

Forex signals serve as recommendations made by human analysts or trading experts or trading software and robots. A forex signal, typically provided by a forex signal service provider, contains vital information, or data, concerning a currency pair at a predetermined time and price. They’re designed to run in real-time. They can be availed in several ways, generally in the form of SMS notifications. However, based upon your signal provider and your personal preferences, you can also avail them through your website, social media channels, emails, and even RSS feeds.

How to read forex signals?

Trading signals help determine the right time to take advantage of forex trading opportunities. You can easily use a forex trading signal service by signing up online and copying the trading signals into your account. You shouldn’t read every forex trading signal service the same way; instead, make sure you understand precisely what it is you are receiving before committing. It is essential that you know the appropriate level of risk for any forex signal you receive. Before you act on a forex signal, understand market conditions and the limitations.

The trading signals providers use a wide range of communication channels, particularly SMS, email, and push notifications, to make sure traders receive trading signals at the right time. Furthermore, you can download platforms that will allow you to directly receive trading signals from your platform. For receiving effective forex signals, many traders utilise social trading communities.

A forex trading signal helps a forex trader to analyse and determine whether to buy a particular currency pair or sell it at a given time. They can also be originated from technical analysis charting tools or even from news-based events.

Forex signals can be freely acquired or bought. Some traders order both free as well as paid signals to enhance their decision-making process. The type of forex signals are determined by how they’re originated.

Manual Free Forex signals

The trader has to use a computerised trading system and manually search for emerging currency trends by studying all forex activity taking place in the market. After that, analyse the information compiled through the extensive study to reach meaningful and valuable results. This typically takes enormous amounts of time and can often be very tedious. Moreover, complete mental discipline is also required to dedicate long hours in front of a computer. Unlike an automated signal generator, a human trader can assess the forex market more intelligently than automated software and robots can. This is because they can understand and analyse currency movements based upon their personal experiences, which software cannot do. They can “sense” the trend rather than “arrive” at it. However, the downfall of generating a forex signal in this manner is that the trader has to utilise his/her own knowledge and intelligence to arrive at the results. Since humans are liable to make mistakes, all researching efforts can still go to waste if the person does analyse the results.

In automatically-generated forex signals, the trader simply inputs some information for a particular currency pair while the software does all the analysis. The software automatically determines appropriate actions based upon your decision to sell or buy a currency pair. It does the fundamental analysis, determines the price action and reduces the complexity of analysing current forex market trends, which significantly helps the trader in saving a lot of operational time. Automated forex signals greatly help in live forex trading since a lot of time is saved. Many forex brokers prefer to remain updated with current forex market trends through the signals. However, the negative aspect of using automated processes for forecasting how forex markets are likely to perform for a given currency pair is that you’re solely dependent upon the logic contained or ingrained in the software algorithm. It can be limited. There are no guarantees that the software shall be accurate at all times and always provide you with profitable live forex trading insights. While trading at huge volumes, it can prove to be disastrous if you’re completely dependent upon an automated forex signal to make profits.

Finding the Best Forex Signals

Figuring out the best forex trading signals decides your effective profitability inside the trading industry. Unfortunately, most traders become accustomed to facing loss in the trading marketplace because they fail to recognise profitable forex signals and are unaware of the forex industry. To give you out-the-box solutions, we have crafted a brief checklist for the mentioned problems in terms of signals; we have prepared a brief checklist that one must go through before making any move.

After knowing how to trade on forex, the next step that comes your way is to have the proper knowledge and perfect understanding about picking the right time zone to trade forex. The trading market is usually active 24/7. However, there is a specific period during which trading a specific currency can generate high leads and outrageous proficiency. Various researches have shown that the prominent money-spinning time that most traders used to trade gainfully ranges between 2 PM-6 AM EST.

The beauty of forex trading is that it offers a free trial period of a minimum of 6 days for all those new users who want to learn exchange and forex trading without the fear of any loss by opting for a wrong signal. One can easily sign up for a free and costless account and can get the experience of forex trading.

Best services of the trading can be found through the constant trial and error process. First, try to correlate various forex signalling services, analyse each of them and finally choose the one that suits your trading manners.

For proficient FX trading, it is obligatory to keep tabs on all those services that provide you countless Forex signals. It is because the marketplace is full of scammers and fraudulent people, and one can easily fool you by giving any wrong signals, which can cause significant loss to you. So, to avoid such things, you just need to track the whole previous record of the forex signal provider, whether it is a free service or premium. In this way, you can get trading done safely without any fear of loss.

A complete pre and post-trading analysis of the forex market and forex signal provider is necessary. You must have basic knowledge about every FX signal supplier to confirm whether it is working efficiently or not. We have two types of forex analyses:

1) Fundamental analysis: depends upon the supply of the currency you hold, the marketplace, and of all the bulk supply of the coin.

2) Technical analysis depends upon the different chart’s indicators.

Choosing anything starts with the person’s interest, and the same is the case here for the forex signalling services. The type of services for providing signals should be following your skillset and trading demands once you find a single signal that fits into your interest and gives you a helping hand with high proficiency.

If you are on the way, heading towards home from the office, and you came across two restaurants, one offers you a burger with no cool drink, but the other is willing to give you an extra cool drink with a burger, which one will prefer you to go to? Exactly, the one that is offering some extras. The same is the case here in the signal providing services of trading. Always choose those signal providers that are offering some extra flavour. These signal providers offer you sports, educational and economical oriented-trading. Along with that, these services provide graphical analysis of currency as well.

How to use different types of trading signals

Effectively using Various Trading signals is a wonderful art that must be known to every trader to maximise their proficiency and get higher leads. Here, I have discussed in detail how to use numerous forex signals in an efficient manner.

Take Profit and Stop Loss

Taking profit and stop loss is a fundamental and completely antagonistic concept in forex trading. Taking profit means to still stand and close down the trades by the traders once they achieve a certain rewarding level, to heighten further profit. For instance, when you realise that it has achieved a valuable margin, the concerned trader holds it from further rise and fall. This will ensure the trader a higher profit by selling it out.

On the other hand, stop-loss trade means closing down your trade when you come to know that your opted signal is at risk and the market is moving completely in a counter direction compared to the initial marketplace. In simple words, a stop-loss order is enforcing a limit to the trader’s assets just to keep them safe from any further loss.

Trade size is measured in specific units, called “LOTS”. These are transaction currencies in the forex market. Whenever you deal in this platform, all the transactions of buying, selling and placing different orders take place in trade sizes, termed as Lots.

It is also termed as “forex correlation”. It is a statistical analysis of any two correlated forex currencies that have a similarity in potential to rise together at once. If two currencies coincidentally rise at the same time, this is termed as a positive correlation. On the other hand, if the two forex currencies decline simultaneously, it is termed a negative correlation.

It is, therefore, very necessary to supervise correlated FX pairs. Sometimes, the forex traders lose sight of mounting to analyse their trade account and forget to impose a stop-loss limit, due to which they face a heavy loss. Remember, always try to switch on the automated closing points just to avoid any untoward situation.

Many free forex signals providers used to offer costless trading platforms for newbie forex traders and old traders. The main aim of these free forex signals providers is to offer free forex strategies and effective signals daily. But experts suggest never to rely upon free forex signals. To some extent, they offer down-to-earth services, but at the same time, they promote their products and advertisements.

As the word, “premium” suggests, these are the paid forex signals providers that provide quality signals and constructive suggestions regarding the trading strategies. Moreover, compared to the free forex signals providers, premium forex signals provide many extra features and trustworthy suggestions about FX trading.

There are many worldwide unique services about forex trade signals, free and premium. We have mentioned only two trustworthy and affordable services where you can get leading suggestions and strategies regarding forex trade signalling.

Forexsignals.com: This platform provides trading advice, analysis, and strategies regularly.

Forex.com: Offers live streaming top-notch services about the FX trade and its various pros and cons.

How do forex trading signals work?

There are three kinds of forex trading signal:

- Automated algorithm/Automated forex signals

- Human analysis/Manual forex signals

- Semi-automated

A professional analyst develops this type of signal in coordination with code developers, who use the algorithm to suggest trade ideas based on the historical moves and market moves. This type of signal uses technical indicators to observe and identify trade ideas. The most common technical indicators are candlestick patterns, shooting star patterns, head and shoulder patterns, triangle and wedges, Fibonacci indicator, Elliot wave pattern, divergence, liquidity, and hedges. The automated forex signals systems use mathematical formulae to discover the patterns mentioned above. Then, it sends out forex signals when there is a match with parameters their algorithm is programmed to detect. This system is also known as forex robots or expert advisors, as the system works with no human involvement to analyse the marketplace and come up with trade ideas.

Human analysis/Manual forex signals

Unlike the automated forex signals where technical indicators need to be studied, the fundamental indicators play a vital role in suggesting forex pairs. The most common fundamental indicators are news and events, carry trade strategy, market sentiment, volatility, etc. These fundamental indicators greatly impact the forex pair’s price action and influence the forex pair price movement.

The forex trading signal not only works on technical analysis nor fundamental analysis, but with the conjunction and cooperation of these two-market movements, is largely affected. If the technical indicators give you good results and based on the technical analysis, you go for trading. In contrast, if suddenly bad news or events happened, it will ruin your trading strategy, and your capital might be in danger or risk. So, for safe trading, you should follow both of these indicators, technical and fundamental.

Free forex signals vs paid forex signals

When you use the forex signals, free or paid, certain things should be kept in mind for safe trading. The forex signals provider should have a valid and authentic source, and it should be based on fundamental as well as technical analysis, and sometimes also based on big events or news.

Many forex signals providers provide the service free of cost without charging a single penny. One should be more cautious while following these signals as these types of forex signals providers (individual or company) are new to the trading marketplace, and to make their service eye-catching, in the beginning, they provide the service free of cost. In this way, they attract more and more people, and once their follower reaches target figure, they switch their service to a paid one. It happens when the forex signals provider has a reliable source and the clients make money from it; otherwise, the case may happen opposite to it. So, for safe trading, always invest 10% to 20% of your capital while following these free FX signals.

Paid forex signals are shared by the company, individual (trading expert), or any other service provider with a sound tracking record, strategy performance, and profitable trading history. They are responsible for what they shared with their clients or subscribers and are answerable for what subscribers are paying for. Paid forex signals providers will look at how the signals are derived using different chart indicators, fundamental analysis, technical analysis and risk management profile, etc. The more they provide the information to the subscribers, the more ease they will feel. This is how the subscribers demand the paid forex signal providers to share the signals using their experience and expertise.

How to Choose the Best Forex Signals Provider

Choosing the best forex signals providing service is a highly critical task. It is the same as you are searching and choosing for a teacher who could give you proper guides regularly. Only the best forex signals providing service can give you high leads and proficient guides. Before choosing any best forex signals furnishing service, the following things should be kept in mind: timeframes, win rates, reliability of service, reputation, performance, drawdowns, and many more aspects. Here, we are going to discuss each of them in brief.

Win rate plays a key role in the proficiency of a trader’s trading journey. In the world of FX, trade signalling win rates take sides with the trading edge.

When it comes to forex trading, every trader has a burning desire to achieve high win rates. It is because consistent win rates can make them more profitable. But also, this concept is sometimes proven wrong that only efficient win rates can help you achieve high leads because many things are coming under consideration while talking about the win rates. So, it is safe to say that the win rate analysis must be considered by subscribing to any forex signal provider. Otherwise, taking any wrong steps can result in great loss.

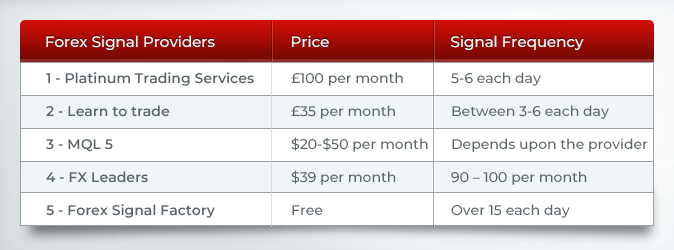

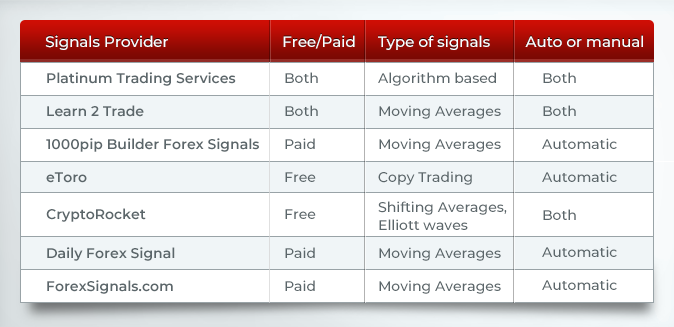

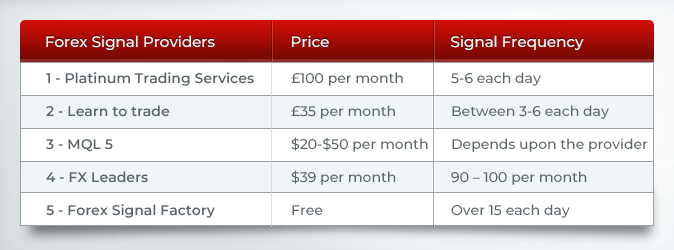

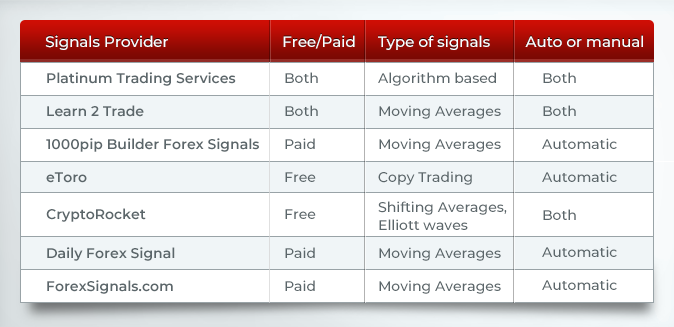

Usually, traders always look for effective signal providers with a reasonable pricing package offering high features. In this regard, here, I have compiled a list of the Best Forex Signals Providers with a very affordable pricing range:

While selecting a forex signal provider, the choosing of appropriate time zone holds great importance in making an effective profit. It is to be noted that forex trading operates majorly in four different time zones (New York, London, Tokyo, and Sydney), which means that it operates 24 hours round the week. All the worldwide trading markets having coinciding time zones. It shows that the process of trading never stops round the clock. When the time zone of one location completes, it marks the start of the next country’s time zone, and in this way, the process remains continuous.

The different analyses had proven that the most prominent time zone is the GMT Time zone for forex trading, with the following schedule:

Summer open: Sunday 10:00 pm GMT Winter open: Sunday 10:00 pm GMT

Summer close: Friday 09:00 pm GMT Winter close: Friday 10:00 pm GMT

Best Forex Signals Providers in 2021

Forex trading has become one of the most demanding and popular industries among people around the globe. Research has shown that this industry is flooded with more than 200 forex signals providers guiding people and furnishing them with the trading strategies. But the question arises which forex signals provider would be the most reliable and trustworthy to get into touch with. Well, to make this ambiguousness clear, I have compiled a list of top 6 forex signals providers in 2021, along with their amazing features:

If you are connected to the USA time zone and looking for the best broker to furnish you with effective and advantageous leads, you are well placed to have aFOREX.com or IG broker.

If you are connected to the USA time zone and looking for the best broker to furnish you with effective and advantageous leads, you are well placed to have aFOREX.com or IG broker.

Which broker is best for forex signals?

This is an amazing broker with the following features:

- Best for active forex traders

- Minimum 100 units of the base currency account

- World’s largest MetaTrader broker

Advantages and disadvantages of forex signals

Professional analysts generate the trading signals using different fundamental and technical indicators or produced by the automated forex software. The sole purpose of sharing these signals is to help forex traders to make informed trading decisions. However, besides its advantages for forex traders, it also has some flaws, which have been discussed below.

Advantages of forex signals

It is very difficult to watch the forex market all the time and search for new opportunities every time. So, instead of wasting time and energy searching for new opportunities, you simply search for a reliable forex signals provider service with sound tracking records and history. Also, when you constantly receive these signals, slowly and gradually, you start understanding the market.

Disadvantages of forex signals

The first and the foremost disadvantage of forex signals providers is that there are a lot of scams. They label themselves a professional trader or analyst, but one doesn’t know about them.

How reliable are the trading signals?

Trading signals are provided either by an expert trader analyst, a company, or an automated forex robot if subscribed to the online forex trading signal service. Experts share the signals based on the technical analysis and fundamental analysis of the market or currencies. But one should not follow these signals blindly, as every analyst could not be 100% true. If you cannot do the fundamental research and blindly follow these signals, then the trading becomes just like gambling. If you are still interested in investment, invest a small amount of your portfolio due to the volatile nature of the forex trading market.

How to understand the forex trading signals

A forex trading signal alerts the traders; where to take entry and where to exit the position. The forex trading signal is for the specific interval of time and price based on the fundamental and technical analysis. It is up to the trader when to respond. It should be kept in mind that the forex trading signals are efficient only when used at the right time. To understand the signals, you should know about the basics of the market and the currencies.

Should I use a free forex signal service?

If you are using free forex service due to the lack of time, then there is nothing wrong with it, but there are certain things you should keep in mind. First, when you go for the free trading signal source, track their past trading signals and assess their accuracy. Second, before going to the payment, make a demand of free trials for few days or even for a month to assess them, because not every forex signal provider wants to make you succeed.

How are forex signals sent?

The forex trading signals are sent by traders or automated sources to the clients through emails, SMS, or forex trading platform. These signals describe the entry and exit points of the currency pair for a specific time period, along with the target profit. For example, when the market is in a more bearish state, the entry point for the currency is divided into two to three phases to getting the average entry price.

What is a forex signal service?

A forex trading signal service is signals provided by traders based on the fundamental analysis, technical analysis, news or events, or ongoing trend. The traders use different analysis tools or charted analysis/indicators for the forex signals, i.e. day moving average, exponential moving average, etc.

How to trade forex signals

As a beginner in forex trading, when you get the forex signals from the traders with specified entry price and exit price, stop loss and profit target, just copy all these and go for the trade. But, on the other hand, the experts in forex trading do further analysis and play with stop loss and exit price to get more profit.

The forex signals are not illegal, but some signal provider services (companies) do not fulfill the legal requirements. For a company to be legal, it needs to be registered with a country, have a bank account, open to the public, etc. The company’s legal status has nothing to do with you as far you enjoying the service.

How much do forex signals cost?

It depends on your investment and varies from trader to trader and forex signals providers. If you want to invest $1,000, then go for a trader who charges $50 per month. This way, you will make a handsome profit every month. Also, do an assessment of your portfolio as well as signals provider.

From all of the discussion above, it is concluded that forex trading is not the path to success until and unless you are not aware of the basic principles. These principles include money management, risk management, risk control, education and experience, and last but not least, the emotional discipline. Managing out the assets and the risk is one of the prerequisites of a successful trading experience.

The Platinum Formula:

Perfect Fundamentals + Perfect Technical Analysis + Perfect Logic + Perfect Risk Management = Perfect Trade

THE PLATINUM WAY

At Platinum Trading Academy, United Kingdom, we teach all individuals from different walks of life to become a full-time trader or create a secondary revenue stream by trading part-time. We trade in an Institutional Way by letting the market come to us and being patient. Using Platinum’s Trading system you can take many Pips out of the market. We can ensure using this style of trading your trading will make a turnaround as you will become much more consistent.

If you want to trade like the professionals do, making consistently profitable returns from your trading, get in touch with us and we will demonstrate live exactly how we approach the markets.

Download our free ebook to read about the various Trading Patterns that work in the Financial Market. Watch Trades of the Week Videos in our video gallery. Subscribe to Platinum’s Forex Newsletter.

Hopefully, you have enjoyed today’s article. Thanks for reading!

Have a fantastic day!

Nisha Patel

Live from the Platinum Trading Floor.

Want to take your trading to the next level?

It all starts with our Free Forex Consultation!

If you are connected to the USA time zone and looking for the best broker to furnish you with effective and advantageous leads, you are well placed to have aFOREX.com or IG broker.

If you are connected to the USA time zone and looking for the best broker to furnish you with effective and advantageous leads, you are well placed to have aFOREX.com or IG broker.